MONTGOMERY, Ala. — Alabama lawmakers, joined by leaders in the private and nonprofit sector advocated for legislation that creates a new child care tax credit program and urged the Alabama Senate to preserve the bill as it makes its way through the Legislature’s upper chamber.

Through employer tax credits and child care center grants, the bill would help supplement employers and providers to expand and improve child care resources across the state. Employers could get a total of $15 million in credits in the first year and up to $20 million in 2027. A separate provider tax credit and grant program would each be capped at $5 million.

The bill is part of a seven-bill package unveiled in March that was designed to break down barriers to employment, with Alabama having among the lowest labor participation rates in the country at around 57%.

House Minority Leader Anthony Daniels, D-Huntsville, is the bill’s sponsor in the House, and Sen. Garlan Gudger, R-Cullman, is carrying the bill in the Senate.

At the press conference at the State House, Gudger said a lot of Alabama could be considered a “child care desert,” and that improving the availability of child care could make a significant impact on bringing more Alabamians into the workforce.

“In 2022, nearly 85,000 families in the state found themselves without viable child care options due to staffing shortages, affordability or concerns about quality,” Gudger said to a crowd of about a dozen people.

“In Alabama, parents make up 35% of the workforce, meaning access to high-quality, affordable child care would boost labor force participation and drive economic growth at regional and statewide levels.”

Gudger said that the bill is projected to affect more than 7,000 families in its first year were it to become law, and as many as 58,000 families over a five-year period.

Last week, the bill passed through the Alabama House, but not before several amendments were adopted that reduced its scope. Originally written to be capped at $35 million after five years, the child care tax credit program would now be capped at $20 million after three years.

Additional amendments adopted by the House further reduced the scope of the program, though Gudger said he considered those amendments to be a fair compromise, and urged his Senate colleagues to support the bill in its current form.

“We wanted to work with our budget chairs to make sure that we didn’t exceed anything that they didn’t want us to; they’re looking at future finances of where the state of Alabama is, and so I think it’s a good compromise,” Gudger told Alabama Daily News.

Karen Johnston, regional director of governmental affairs for Toyota, noted the impact the child care tax credit program could have on the automotive industry in particular.

“The automotive industry is in a historic transformation, while at the same time, dealing with the loss of workforce and an unprecedented skills gap; we could close this gap by 50% if we bring in just 10% of women into the manufacturing sector,” Johnston said.

“Women are the manufacturing industry’s largest talent opportunity, yet unfortunately, the main barrier for women to enter or re-enter the workforce is lack of child care. Providing high quality, affordable and reliable child care really is the key to maximizing workforce participation in manufacturing.”

Some North American Toyota manufacturing plants already provide 24-hour onsite child care, such as in the plant in Georgetown, Kentucky. At these sites, Johnston said there was a clear increase in productivity among workers.

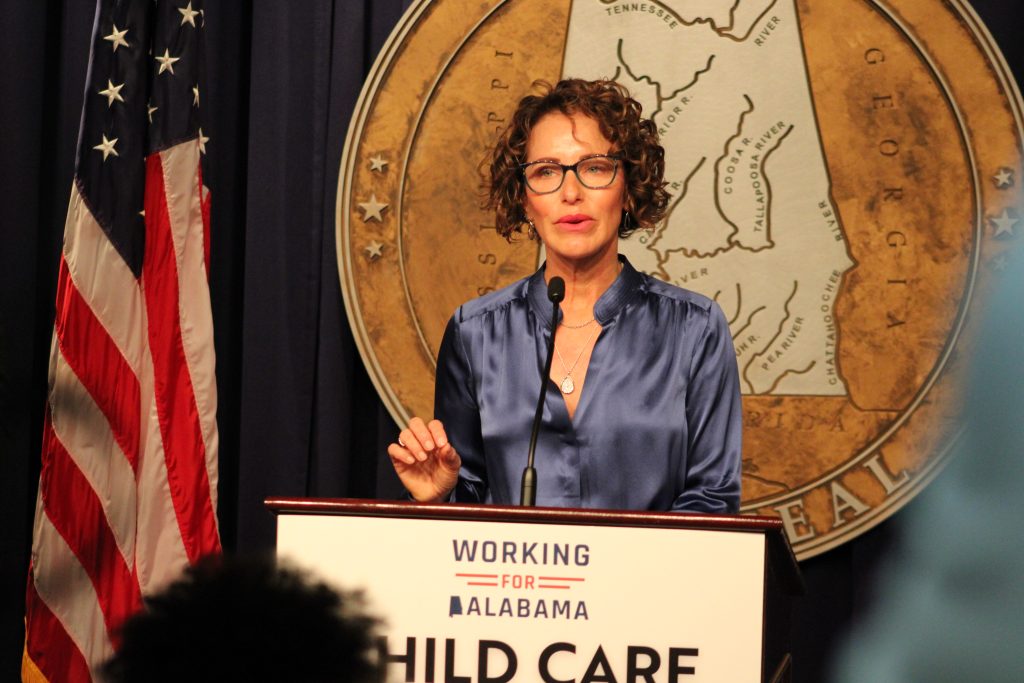

Melanie Bridgeforth, president of the nonprofit organization Women’s Foundation of Alabama, called the bill’s introduction a “watershed moment.”

“I want to draw your attention to (the) fact that 80,000 women in Alabama remain missing from the workforce, putting Alabama dead last in labor force participation for women in the American South,” Bridgeforth said.

“When women exit the workforce, it impacts each and every one of us, robbing local economies of an estimated $12 billion every year. There’s still time (for this to pass) if members act now. Let’s not let time run out on Alabama families.”

For employers who support child care services for their employees, the bill would provide up to $600,000 in tax credits per year. For child care facilities, the bill would provide up to $25,000 per year based on the quality and capacity of their facility.

Nonprofit child care providers would be afforded up to $50,000 in grants under the bill, which if passed, would go into effect on Jan. 1, 2025.

Gudger told ADN that he anticipates the bill appearing next in the Senate Committee on Finance and Taxation Education on May 1, chaired by Sen. Arthur Orr, R-Decatur.